It's been said that holding 5-10% of commodities in a portfolio adds diversification and lowers volatility. In fact many great all-weather portfolios contain some commodities through the use of ETFs like DJP or GSC. These last ones are biassed towards oil and gas, but also own agricultural commodities, metals, etc, and just a little bit of gold.

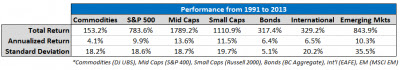

We do not agree. Commodities only INCREASE volatility and REDUCE yield of a portfolio in the very long run. Here you can read one interesting paper about it. They usually behave well when the economy is soaring (the same as stocks but with some time gap), so we don't get any low or negative correlation. Below you can compare the returns of commodities, stocks, and bonds, to see commodities poor behavior:

Some of you might think that how it's possible that we advocate for owning gold and not commodities. Aren't they similar? Some economists find a strong correlation between the above asset classes. We don't know how they do the numbers but we don't see this correlation in pure real terms (we think the studies are done in nominal terms and they confuse inflation in both commodities and gold with correlation). Below you can see a very clear graph comparing gold with the two most famous commodity indices:

For all the above, we do think adding gold but not the rest of commodities to a portfolio is an excellent idea. The combination of gold and stocks reduces the volatility of the portfolio.